Tuesday, April 08, 2008

Market Outlook NDX for Apr 8th '08

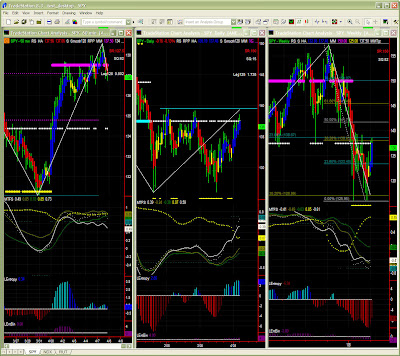

Dominant TF: 60mins with weekly chart coming back too.

Swings: DN-UP-DN

Market Direction (Daily): hesitation on resistance level

Cycles: unreliable

Position (60mins): flat, or long with tighter stops

NDX has been understandably hesitant on MM resistance level. Current levels (~1880) are key test levels for this symbol.

We'll note the same key level on EURUSD : 1.5625

60mins: undecisive

NDX has reached its target level and is more or less hovering there still. It is therefore a little difficult to project accurately what is coming next. NDX could go either way on this test level but a retracement back to ~1840 looks quite plausible in the short term.

Daily: bullish but low significance level

NDX is certainly aiming higher, even possibly back to 2000 within a few weeks. However a retracement is quite possible along the way (EntBin = 5). MTFS is now fairly positive so a pull back wouldn't attenuate the current upper bias.

Weekly: patience...

The Swing indicator is hesitating, but is still DOWN. MTFS is still moderately bearish despite the bounce in the last 2 to 3 weeks. Again, we have to see completion of the MTFS pattern and dissipation of negative pressure in the market.

NDX has now reached PR1 (~1880) exactly as anticipated, but the MTFS pattern should certainly prevent NDX from going higher for now. It seems a pause or a retracement is inevitable. The 2000 level will later on be a lot more determinant for future direction.